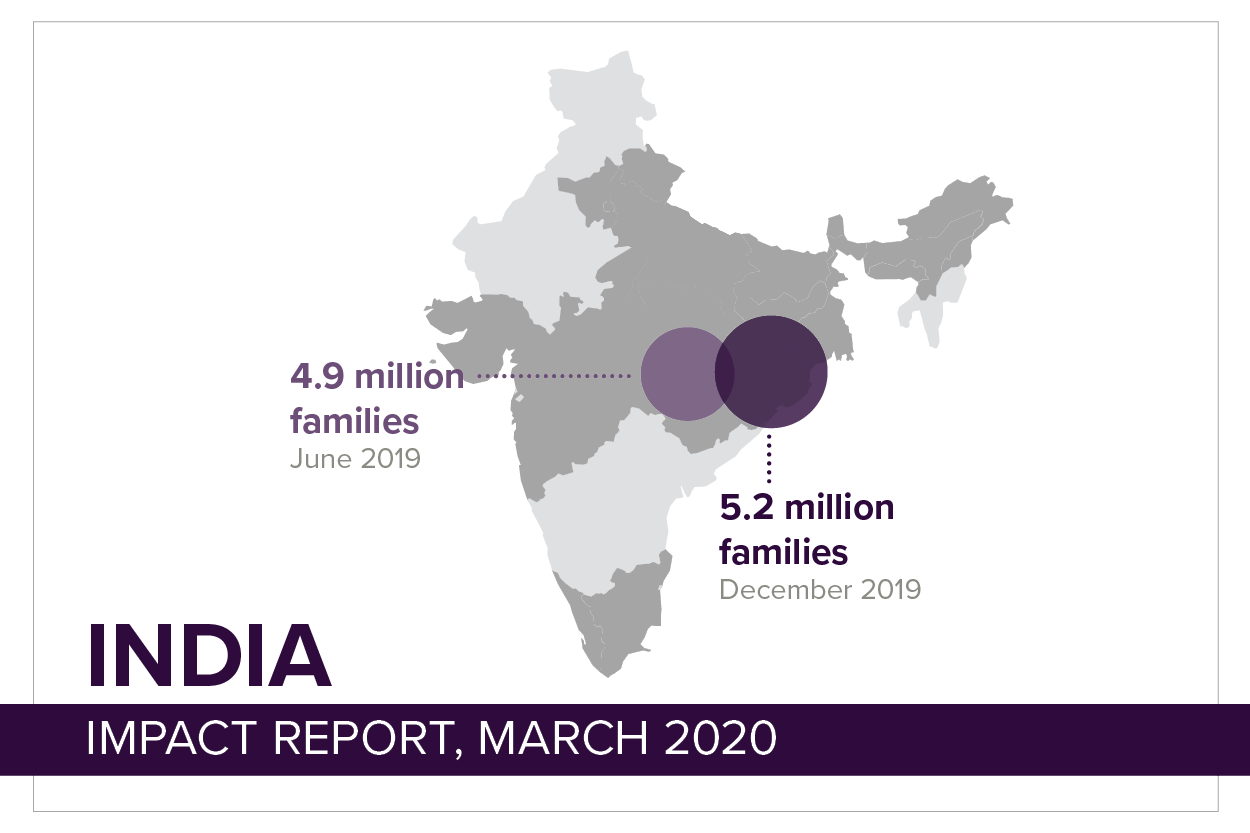

Data to December 2019

*Understand portfolio at risk and operational sustainability

Highlights

Over the past six months, our partners in India saw continued growth, particularly our newest partners Satya and Pahal, as well as Cashpor and ESAF.

Our partners continue to introduce new financial products that meet the specific needs of the people they are serving. For example, Cashpor asked the women they serve who live in poor rural areas of India about their financial needs and confirmed they needed more money, in addition to loans to fund activities to generate income. They needed lump sums of money to improve their families’ standard of living, loans which they could pay back in regular instalments to smooth the cost of their purchases over time.

Cashpor listened to their clients and introduced the BADA loan, which means ‘big’ in Hindi. BADA loans are provided to women in addition to their loans for income generation. BADA loans give women the flexibility to choose how best to spend the funds, whether on their children’s health or education expenses, or improvements to their shelter by installing a toilet or upgrading a leaky roof.

Lessons

Opportunity’s partners continue to move towards using digital technology to make financial services more accessible and give clients more freedom with transactions. Paperless methods of data collection and cashless transactions, whilst still in their infancy will enable our partners to operate more efficiently and safely, both in terms of security as loan officers are less likely to be targeted for robberies, and in term of health as cash can be a means by which communicable disease is spread from person to person.

India Microfinance Partner Summary

|

|

Families Reached |

Loans Outstanding A$'000 |

Operational Sustainability |

Portfolio at Risk >30 days |

|---|---|---|---|---|

| ESAF/NESFB CASHPOR SATYA PAHAL |

4,347,468 | $2,085,379 | 121% | 3% |

| MARGDARSHAK SAMBANDH ADHIKAR SAMHITA |

643,192 | $211,496 | 113% | 1% |

| GO FINANCE ANNAPURNA SHIKHAR PRAYAS |

234,702 | $106,487 | 111% | 1% |

| Overall | 5,225,362 | $2,403,362 | 119% | 2% |

Impact Stories

Your support is empowering these women—and millions more like them—to create a new future for their families, free from poverty.

“My dreams are my children. They want to study so I will educate them and also help them to have a good life.”

– Ujjawala, Nagpur

Ujjawala started her own market stall selling jewellery and accessories to earn enough to send her children to school.

Shivali and Savitri – friends, neighbours and two women committed to building healthier villages in India.

Opportunity is dedicated to seeing women empowered through microfinance, as well as health, safety and education.

Microfinance is a complex humanitarian intervention. It is also a sector that is experiencing great change. Mark Daniels, Opportunity International Australia’s Asia Programs Director, explains.

In this second instalment on microfinance, Mark Daniels, Opportunity’s Asia Programs Director, explores the changing nature of microfinance and the challenges that lie ahead.