Who's Who In The World Of Microfinance?

By now you may have read the powerful impact stories of Opportunity loan recipients like Marince, Panchratni and Remy – women who’ve all received a hand up out of poverty through small loans to start their own businesses.

But who’s who in the wider microfinance sector? And how does Opportunity work collaboratively with other organisations to transform the lives of families living in poverty? Let’s meet some of them…

Microfinance CEOs Working Group

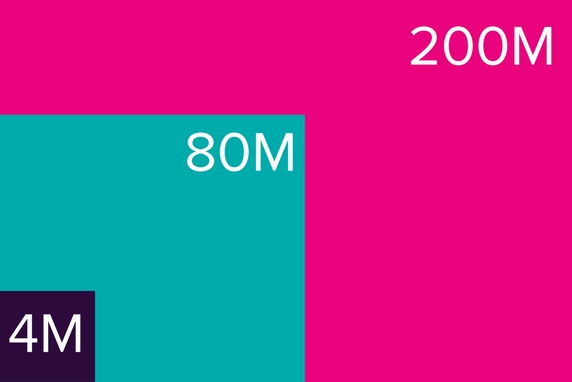

The Opportunity International Network is one of 10 organisations who have come together to form the Microfinance CEOs Working Group to address the changes and challenges of an evolving microfinance sector. Together, the Group represents 250 microfinance institutions who reach upwards of 80 million loan recipients. To get a sense of the scale of this outreach, here’s an illustration below:

4M – the number of Opportunity loan recipients

80M – the number of loan recipients represented by the Working Group

200M – the approximate number of loan recipients in the whole microfinance sector.

The mission of the Working Group is to, “Support the positive development of its member organisations and the microfinance industry at large, so the field can reach its full potential of bringing financial and related services to those who have been traditionally excluded.”

The Working Group has four main activities:

- Advocacy – promoting microfinance to key influencers and the media

- Industry strengthening – developing and delivering best practice services to families living in poverty

- Institution strengthening – modelling best practices of social microfinance and continuous improvement of these practices

- Relationship building – collaborating and sharing information between members for the good of the industry.

Social Performance Task Force

Whereas the Working Group represents a sizeable portion of the microfinance sector in 80 million loan recipients, The Social Performance Task Force (SPTF) promotes client focus across the whole sector. Started by the Consultative Group to Assist the Poor (CGAP), the SPTF’s greatest achievement has been the development of the Universal Standards of Social Performance Management.

The Universal Standards ensure that MFIs measure the success of their programs, not just through financial performance, but through social performance. That means putting microfinance clients at the centre of programs, and measuring the social impact of programs on clients’ lives, e.g. asking the question – how are we practically helping clients transform their lives?

As a summary, here are the six dimensions of the Universal Standards:

Opportunity also sits on the Board of the SPTF and we have a dedicated team to help implement the Standards across our global programs. To find out more about how Opportunity is tracking in meeting our clients’ needs, visit our website spm.opportunity.org

Other industry resources

In order to measure the social impact of our programs on client’s lives, we need data! So where do we turn?

The Microfinance Information Exchange, or the MIX, provides institutional level data on key operational, financial and social indicators for MFIs to see how they compare with each other. Similarly, Microfinance Transparency provides pricing data on the cost of microfinance products and services across the sector. The trouble with these organisations is that they cannot force MFIs to submit data for these indicators so the available data might not be fully representative of the entire sector.

There’s also tools such as the Progress out of Poverty Index (PPI) and the Social Performance Assessment Indicators (SPI4) which Opportunity uses extensively to collect data from our clients and program partners to track social performance.

You also have voluntary and mandatory national and government regulators that also promote client focus at MFIs through social ratings and external assessments such as SMART Certification, which is the most rigorous accreditation in the provision of client-focused microfinance services. Many of Opportunity’s program partners are working towards achieving SMART Certification, currently held by only 60 MFIs (there are approximately 10,000 MFIs globally).

The benefits of collaboration

As there’s strength in numbers, working together with other organisations in the sector not only creates a forum for shared knowledge, but the opportunity to participate in research to develop the sector and promote the importance of socially focused microfinance at the same time.

Social microfinance is, in a way, a movement, to put microfinance clients at the heart of what can sometimes be a complex and difficult financial environment. It’s about going back to the why behind the what – the core of what we do through microfinance is to transform people’s lives by giving them a means to work their way out of poverty, with dignity and purpose.

The ultimate Who’s Who

It would be remiss of me to forget the ultimate who’s who in the wider microfinance sector – and that’s you.

Because without your support, we would not be able to transform people’s lives. I encourage you, if you haven’t already, to invest in a sector that deeply cares for the people they serve – people who need a hand up from you right now.

Because reaching only 200 million people is not enough in a world where almost 3 billion people still remain in poverty. Please give today.

References:

http://microfinanceceoworkinggroup.org/

http://sptf.info/images/usspm%20impl%20guide_english_20141217.pdf