New study highlights quality of life benefits of Microfinance

Opportunity International is proud to be part of a new study, launched on 1st June, which shows that Opportunity clients benefit from increased quality of life, improved healthcare, education and nutrition.

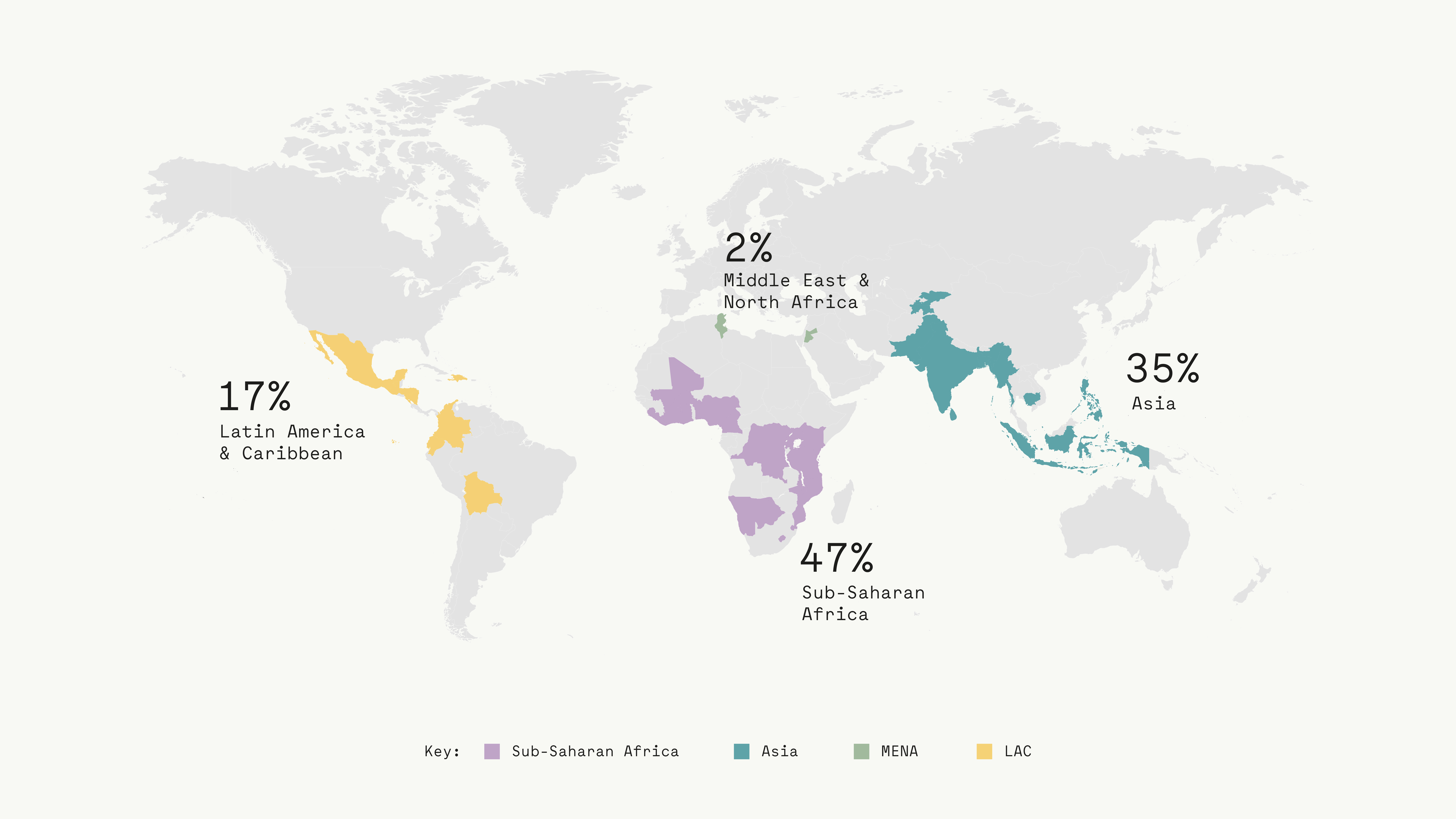

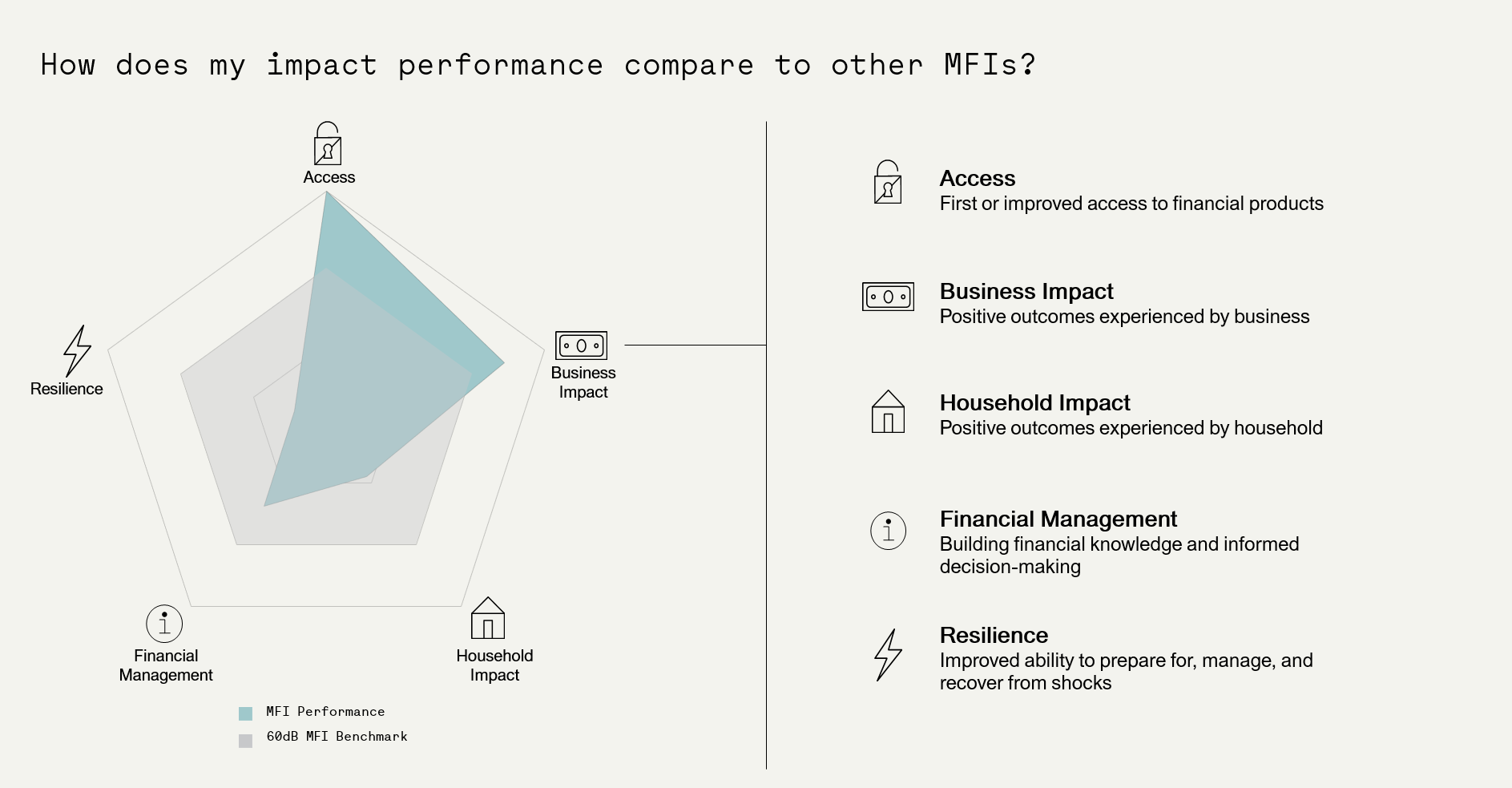

60_Decibels, a global, tech-enabled impact measurement company, interviewed 18k clients across 72 Microfinance Institutions (MFIs) in 41 countries in early 2022, including over 2,000 of Opportunity’s clients across 9 partners. The study, for the first time, gives standard, comparable outcomes data for the microfinance industry. Opportunity partner Cashpor, based in India, is one of the higher performing MFIs included in the study.

Overall the study found that microfinance:

- Does a good job of reaching people without access to financial services

- Improves the quality of life of clients, typically through increased business income and improvement in household outcomes (access to health, education, quality meals and home improvements)

- Improves the ability of clients to deal with economic shocks – increasing savings balances for clients and reducing financial stress

For Opportunity’s 9 participating partners the study showed that:

- Clients reported greater resilience as a result of the financial services that they receive, with over 80% of Opportunity clients better able to manage their finances and most clients reported that their ability to meet unexpected expenses improved as a result of the support they had received from the Opportunity partner.

- Opportunity partners Coop Aspire (Dominican Republic) and Cashpor (India) are two of the highest performing MFIs in the study:

> Over 80% of Cashpor clients experienced an increase in business income

> 66% of Aspire clients reported that their quality of life was very much improved (with a further 27% reporting a slight improvement in quality of life) as a result of the services received - A majority of clients at each of the 9 partners reported increased business income, an increased ability to manage finances, and improved capacity to cope with unexpected economic shocks.

We are excited to see how our programs are helping those most in need and the positive outcomes that result. We also value the extensive feedback from our clients, which helps us understand where we can work with our partners to improve our services, address client challenges and more effectively serve those most in need.

To learn more about the study, see 60 Decibels' 2021-22 Microfinance Index.