Data to December 2019

*Understand portfolio at risk and operational sustainability

Highlights

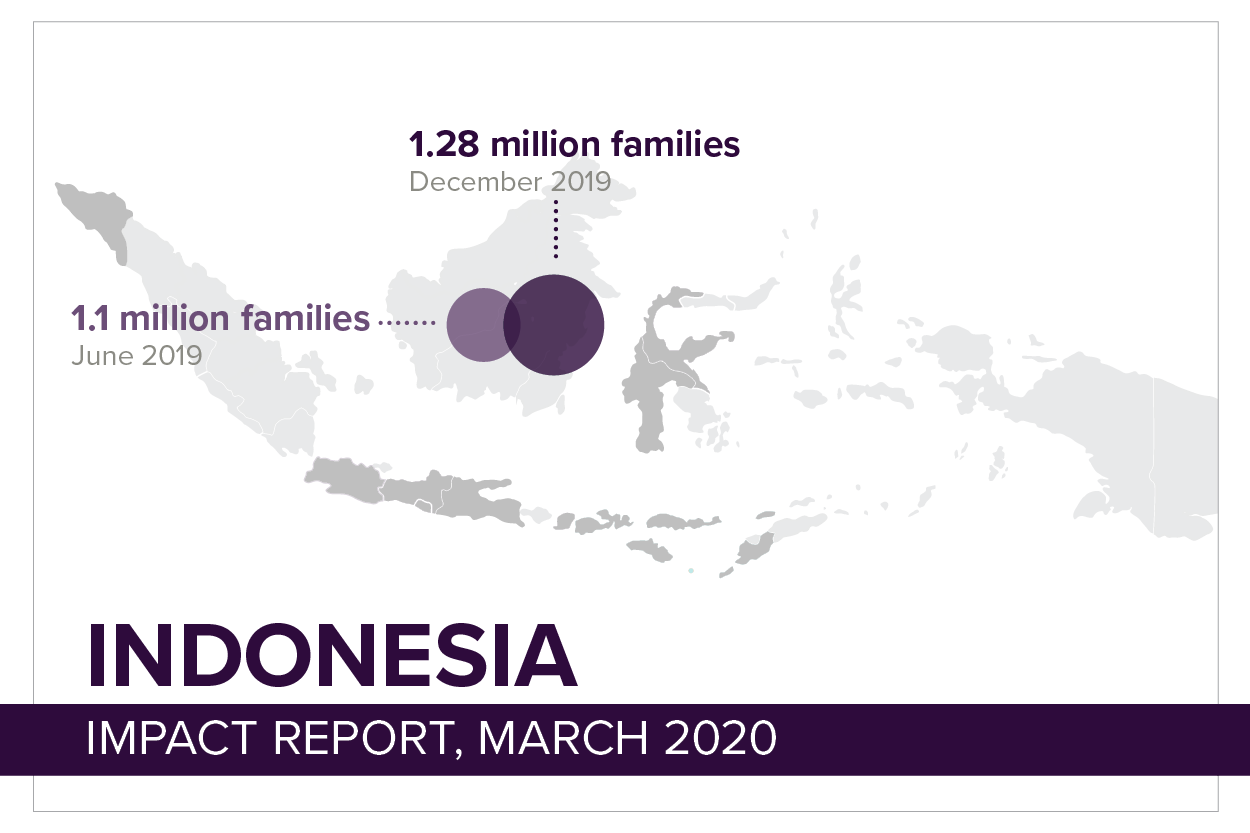

In 2019, Opportunity’s partners in Indonesia continued to expand rapidly, with 25 per cent growth across the board. In particular, KOMIDA and TLM continue to grow rapidly, with KOMIDA recently reaching over 745,000 clients. Partners are expanding their services into more remote areas where people have less access to financial services than those in more populated regions.

Opportunity’s partners are deepening their understanding of the needs of people living in poverty whom they serve. They are responding through the expansion of financial products in addition to livelihood loans, for example, loans to improve access to clean water, adequate sanitation and shelter. One partner is exploring how they can better include people with disabilities.

Lessons

Opportunity’s partners continue to move towards using digital technology to make financial services more accessible and give clients more freedom with transactions. Paperless methods of data collection and cashless transactions will enable our partners to operate more efficiently and safely, both in terms of security as loan officers are less likely to be targeted for robberies, and in terms of health as cash is a means by which communicable disease is spread from person to person.

Indonesia Microfinance Partner Summary

| Families Reached | Loans Outstanding A$'000 | Operational Sustainability | Portfolio at Risk >30 days | |

|---|---|---|---|---|

| KOMIDA | 745,280 | 153,089 | 124% | 1% |

| BAV | 382,412 | 114,656 | 133% | 3% |

| TLM Co-operative | 113,670 | 16,987 | 139% | 1% |

| YCAB | 39,252 | 5,287 | 131% | 6% |

| Overall | 1,280,614 | $289,999 | 129% | 2% |

This project is supported by the Australian Government through the Australian NGO Cooperation Program (ANCP).

Impact Stories

Your support is empowering these women—and millions more like them—to create a new future for their families, free from poverty.

“I only wish my children could finish high school.”

– Marce, Rote Island

Marce makes and sells cakes, as well as fish she catches along the beach, to provide for her family.

"I hope my children can now be successful."

– Oktavin, Rote Island

A savvy business idea and a small loan helped Oktavin start a grilled fish business that quadrupled her family's income.

“Sometimes when we get a small harvest, I give some to my son to eat."

– Heni, Rote Island

Heni part owns a community garden which provides her family with fresh food and addtional income.

“I’m happy when I see all my children go to school.”

– Asria, Rote Island

With a small loan, Asria started a business making and selling tempeh – and doubled her income.